Warning: This software on this page is no longer supported

![]()

Overview

AIM-Trader: A friend for volatile markets.

Trading is not easy, it takes a lot of time and skill. In the 1970s a man named R. Lichello developed an algorithm that takes the sweat work out of trading. This algorithm has stood up to the test of time. It works best in volatile markets (like today) but also over the long haul it compares favorably to other long term strategies.

What it is: The AIM algorithm is best compared to a shopkeeper who diligently tries to optimize between cash and inventory. When the stock price is low, it will buy, when the stock price is high, it will sell. But thanks to some clever mechanism it will not sell out completely. Even if a stock goes for the moon. On the other hand, it is careful on the buy side. It tries to preserve cash, so it slowly increases the number of shares as the price goes down.

R. Lichello has documented the algorithm in a book. Called How to Make $1,000,000 in the Stock Market Automatically. A title that put me off to be honest! Luckily I also happened upon a description of the algorithm online. Otherwise this app might never have seen the light of day.

As always, algorithms have to suit you in order to be truly successful.

Screenshots

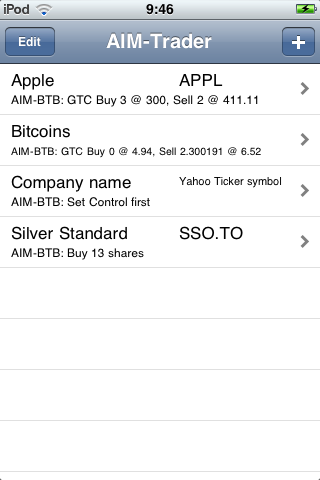

The main screen (Note that these screenshots are from an older version of iOS. Today they look different):

It shows three existing positions and one new position. The existing positions are APPL, SSO.TO and Bitcoins. AIM can be used for more than just shares. The APPL position uses GTC order, the SSO.TO uses market orders.

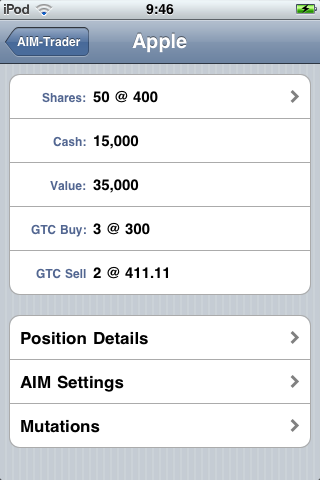

This screenshot shows a position:

It shows the main attributes associated with a position:

- The number of shares and the current quote

- The amount of cash

- The value of shares and cash together

- The GTC buy order

- The GTC sell order

- And three detail links for the other parameters

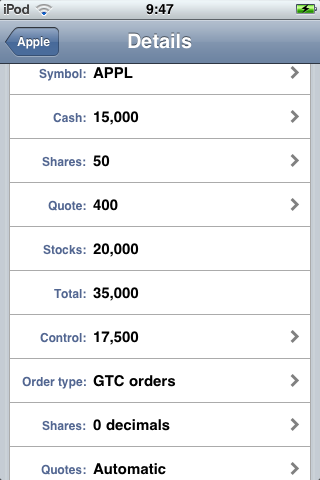

This screen shows the position details:

It shows the attributes of a position:

- The stock symbol

- The cash part of the position

- The number of shares

- The most recente stock quote

- The total value (stock value + cash)

- The control value that is used by the AIM algorithm

- The order type used (either GTC or Market)

- The number of post-decimal sign numbers to be shown in the number of shares

- The source for the quote (either automatic or manual)

This screenshot shows a buy-mutation screen

It shows:

- The number of shares bought

- The amount paid (including commission)

- The share price paid (for recordkeeping only)

- Transaction data

User Manual

Disclaimer

BalancingRock.nl is no certified investment advisor. We only make software. If you use our software to plan your trading activities, remember that YOU are responsible for the results. Consult a certified investment advisor when necessary.

Usage

AIM is a low-intensity approach to trading. It can be implemented in two ways: Using market orders and using GTC (Good Till Cancel) orders.

Using GTC orders

Enter both the orders (sell and buy) with your broker and sit back until one (or both!) of them is triggered. If one is triggered, cancel the other one. Calculate the new set of GTC orders and repeat, …

Using market orders

Check the AIM-Trader advice once a month (!) and place the trades accordingly. Do not trade more than once every month. Doing so would likely undermine the algorithm. If you want more action, use GTC orders instead. A case can be made for certain stocks to check every fortnight, but it could also be considered overtrading. If you really want to check every fortnight, be sure to understand the algorithm and the implications of overtrading.

GTC vs Market orders

While GTC may appeal to the trader in us, I have yet to see that it produces materially better results in the long haul. The discipline of trading just once a month was part of the original algorithm. Its probably best to stick to that.

Quick start

A step by step example to starting an AIM position.

Suppose you want to trade a stock from the Canadian Exchange, lets say, Silver Standard Resources. And suppose you want to start with 10.000 CAD.

You can implement this with the following steps:

Setup

- Start AIM-Trader

- Add a new position: Tap the “+” button

- Navigate to the position details: Tap the new row “Company name” (You may notice the small print message ‘Set Control first. This means that you have not yet initialized the position, we will do that next)

- Navigate to the position details: Tap the “Position Details” row

- Give the position a name: Tap the “Company” row and type in the name (For example Silver Standard Resources. Any name will do. The name is only used to identify the position on the initial screen)

- For auto quotes, fill in the Yahoo ticker symbol: Tap the “Symbol” row and type in the ticker symbol (SSO.TO). You can now use the “Test” button to verify that you receive the correct quote. (For ticker symbols see Yahoo-Finance)

- Enter the amount for the position: Tap the “Cash” row and enter the amount (10000).

- Set the Control value: Tap the “Control” row and accept the suggested value. Not until you have experience with the AIM algorithm and know its in and outs should you change the suggested value.

- (If you did not use the Yahoo quote server, fill in the quote manually by tapping the “Quote” row and typing in the proper value.)

- Return to the overview page, notice how the “At Market” row now has some advice. It will tell you to buy some shares. The total value of which should be about equal to half the cash position. Exit AIM-Trader. Buy those shares now.

Establish the position

- After buying the shares, start the AIM-Trader again.

- Add a “bought” mutation: Tap the company row, tap the “Mutations” row, tap the “New Mutation” row, tap the “Bought shares” row.

- A message comes up explaining that since there are no shares yet in the position, this initial buy will be used as part of the setup and not appear in the mutations list. Simply acknowledge the message.

- Fill in the details. Note: The date and price per share are for record keeping only.

- Go back to the company overview.

- Notice that the advice has changed to “hold”. You can now decide to use either “At Market” or “GTC orders” by specifying your preference in the Position Details. For this example, lets use GTC orders. Go to the position details by tapping the corresponding row. Tap the “Order type” row. And tap the “Use GTC Orders” button.

- Go back to the position overview.

- Notice that the GTC sell and buy orders have not been calculated yet. We need to fill in the minimum order size first.

- Set the minimum order size. Tap the “Aim Settings” row. Tap the “Min order” row. Specify the minimum order size. Be sure to make it large enough such that the commissions that you pay are not too high. Less than a few percent should be enough as long as you keep the SAFE settings at 10%. If the commission is too large a round-trip will put you in the hole. You can check for this by simulating a round trip (i.e. act as if you had a GTC buy order and then act as if you had a GTC sell order, or the other way around)

That is all, you are now set.

Note

- If you would like to automatically fetch a new quote each time the app is started, you can do so now in the Position Details view. Just scroll down to the corresponding row.

- If you use market orders, please be aware that you should typically check on the AIM advice only once a month. Or maybe once every fortnight if you know what you are doiing. But not more than that.

- Even if you use “Market orders” you still should specify a minimum order size.

The AIM Algorithm

The AIM Algorithm was developed in the 70′s and was specifically designed to take advantage of a choppy market. Much like the conditions of today. The algorithm uses the up and down swings to add and sell stocks. For this reason the initial position divides the available capital in 50% stocks and 50% cash. The buy and sell SAFE parameters control the aggressiveness of buying and selling. Much has been said about these values, but if you are just starting out, use 10% for both of them. If you like, please dive into the algorithm an try to understand how it works. Its not very difficult, and a pencil and calculator is all you need. The information can be found in the book or on the AIM Users Bulletin Board. Once you get a feel for the algorithm you can tweak the SAFE parameters to better fit your expectations.

Residual buy’s or sell’s

There is a quirk to market orders. If you do not specify a minimum order size (or a very small one), a buy or sell can result in a residual buy or sell. I.e. a buy or sell advice immediately after the advised buy or sell was made. This was not a problem in the 70′s where after a buy or sell one would forget about AIM for a month before doing the calculations again. The AIM users back then probably never noticed this. Today however with apps like AIM-Trader you will notice these residual buys and sells immediately. This is no cause for alarm, and should NOT be acted upon. When using market orders you should only place your trades once a month (or once every fortnight).

Residual buys en sells do not occur when using GTC orders.

Risks

There is always risk in investing, and the AIM algorithm is no exception. In this section I would like to mention a few just so you know.

-

Any rebalancing investment method (like AIM which rebalances between cash and stocks) is sensitive to the “go to zero” risk. For AIM this means that if a stock goes to zero, you will loose all your investment capital allocated to that stock. To say this very clear: AIM will not protect you from bad stocks!

-

It is possible that at this time we face a unique set of challenges in the market. These challenges could result in a complete loss of confidence in financial institutions. AIM of course cannot protect you from that. Please monitor the financial position of your broker carefully. For this reason, make sure NOT to use a margin account.

-

AIM and margin: We strongly advice AGAINST using margin for AIM positions. Margin can be deadly for your capital. AIM will not protect you from that.

-

Hyperinflation: Some people expect hyperinflation. Stocks can give some level of protection against hyperinflation. However in a hyperinflation stock values go up and up and up. AIM will then keep selling. Exhausting your stock and going almost completely into cash. Which the rapidly declines in purchasing value. If you expect hyperinflation, do not use AIM.